Smartasset payroll calculator

Dont want to calculate this by hand. The minimum tax is assessed based on the New Jersey Gross Receipts Schedule A-GR as follows.

Smartasset Paycheck Calculator Flash Sales 59 Off Www Naudin Be

09 Taxable maximum rate.

. If your health insurance premiums and retirement savings are deducted from your paycheck automatically then those deductions combined with payroll taxes can result in paychecks well below what you would get otherwise. Groceries and prescription drugs are exempt from the California sales tax. California has 2558 special sales tax jurisdictions with local sales taxes in.

Counties and cities can charge an additional local sales tax of up to 25 for a maximum possible combined sales tax of 10. The PaycheckCity salary calculator will do the calculating for you. 24 new employer rate Special payroll tax offset.

You can try it free for 30 days with no obligation and no credt card needed. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. The California state sales tax rate is 75 and the average CA sales tax after local surtaxes is 844.

Provided however that for a taxpayer that is a member of an affiliated or controlled group as per sections 1504 or 1563 of the Internal Revenue Code of 1986 which has a total payroll of 5000000 or more for the return period including periods beginning on or after. Only the Federal Income Tax applies. When you start a new job and fill out a.

However revenue lost to Washington by not having a personal income tax may be made up through other state-level taxes such as the Washington sales tax and the Washington property tax. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Payroll Tax Definition.

If you want to simplify payroll tax calculations you can download ezPaycheck payroll software which can calculate federal tax state tax Medicare tax Social Security Tax and other taxes for you automatically. 54 Taxable base tax rate. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

This number is the gross pay per pay period. Washington is one of seven states that do not collect a personal income tax. Washington has no state income tax.

Subtract any deductions and payroll taxes from the gross pay to get net pay. Payroll taxes are part of the reason your take-home pay is different from your salary.

Use Smartasset S Utah Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Retirement Calculator Property Tax Financial

Free Income Tax Calculators The Best In The Usa

Smartasset Paycheck Calc Top Sellers 58 Off Www Naudin Be

Which Is The Best Mortgage Calculator Zillow Bankrate Smartasset Calculators With Pmi Taxes Insurance Advisoryhq

Smartasset Paycheck Calculator Flash Sales 59 Off Www Naudin Be

Understanding Payroll Taxes And Who Pays Them Smartasset

What It Takes To Be In The 1 By State 2022 Study

Did Government Spending Alone Really Cause Inflation

Smartasset Paycheck Calc Top Sellers 58 Off Www Naudin Be

Did Government Spending Alone Really Cause Inflation

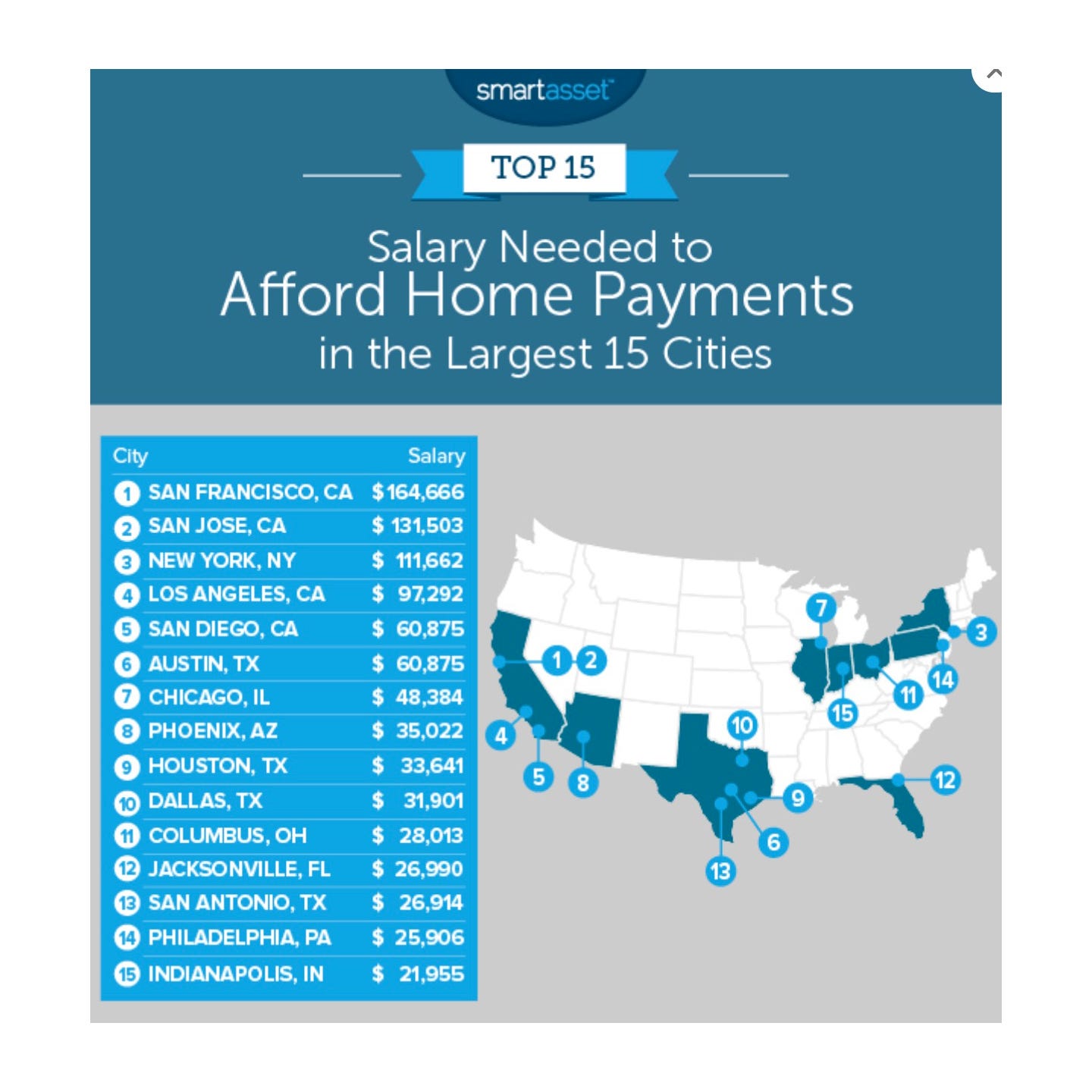

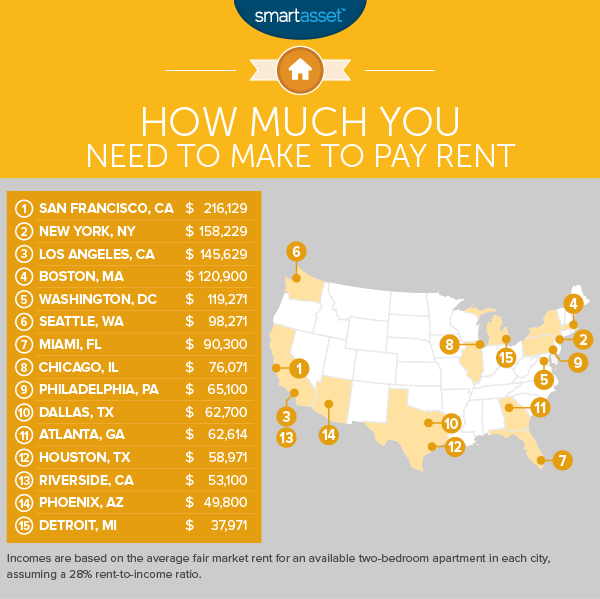

The Income Needed To Pay Rent In The Largest U S Cities Smartasset

Smartasset Paycheck Calculator Flash Sales 59 Off Www Naudin Be

New York Paycheck Calculator Smartasset

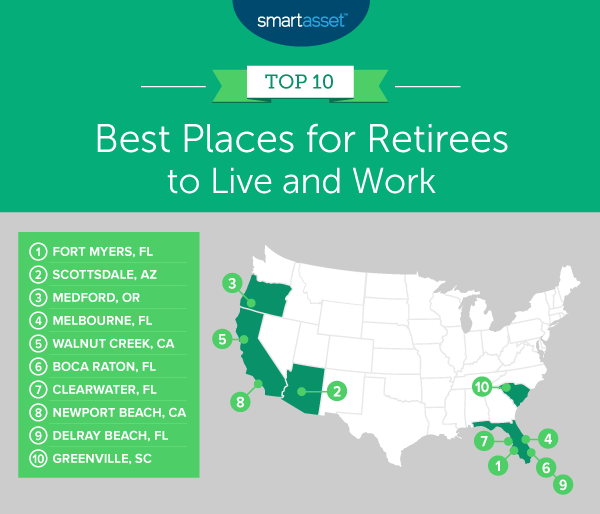

The Best Places To Retire In The U S In 2020 Smartasset

Smartasset Paycheck Calculator Flash Sales 59 Off Www Naudin Be

30 Year Vs 15 Year Mortgage These Charts Show Which Is Better

Smartasset Reviews Retirement Living